i haven t filed taxes in 10 years what do i do

Well determine the amount of years that need to be filed. Ad File Your IRS Tax Return for Free.

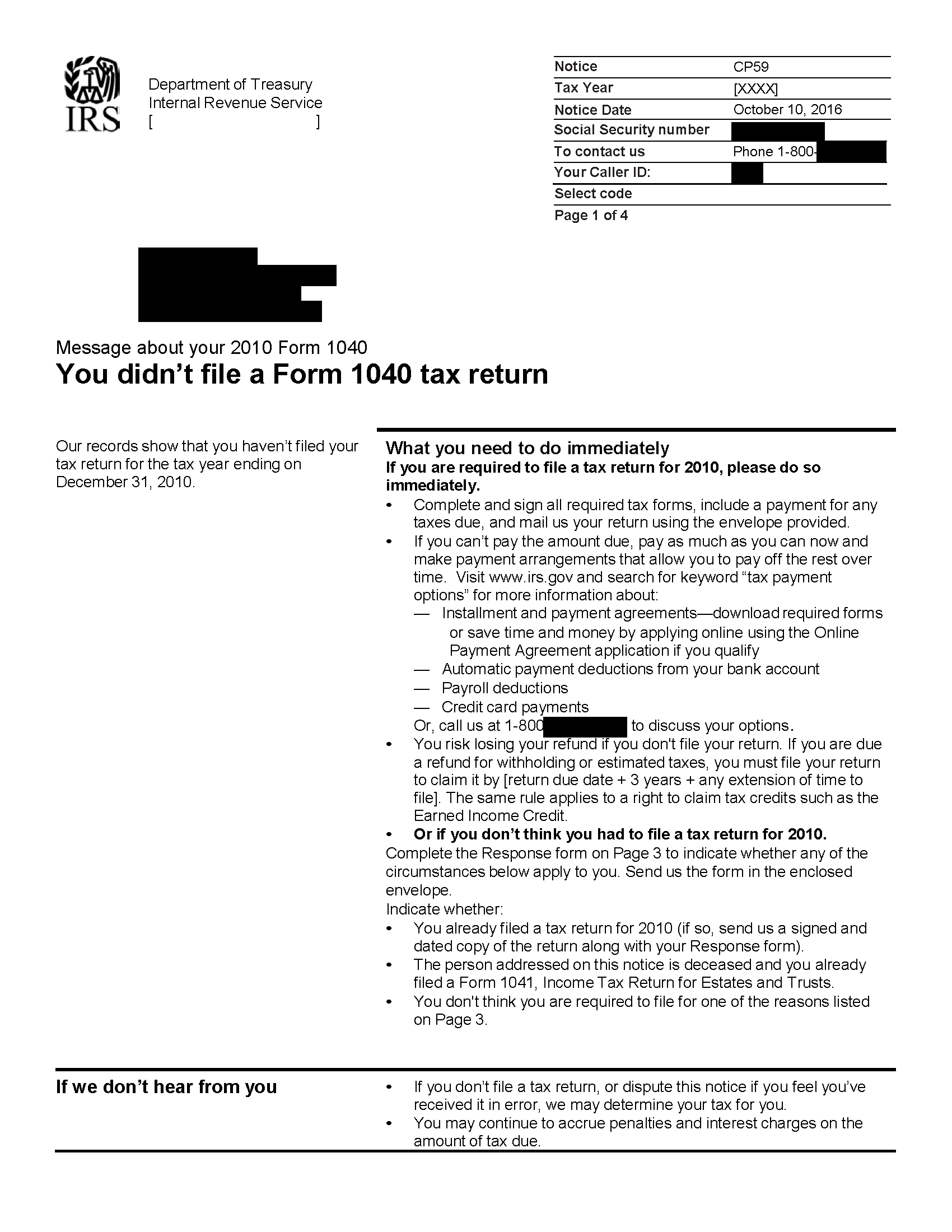

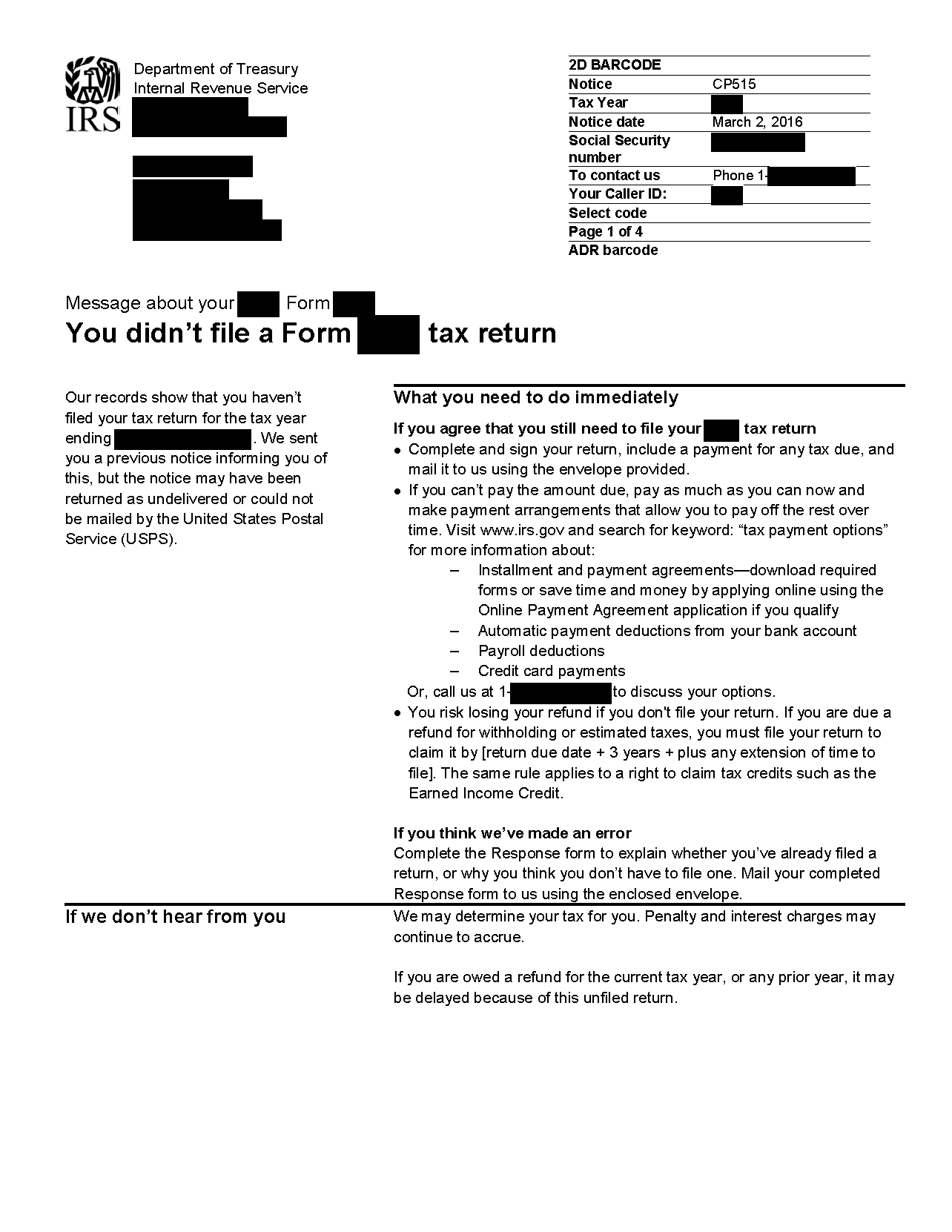

Irs Notice Cp515 Tax Return Not Filed H R Block

No Tax Knowledge Needed.

. More 5-Star Reviews Than Any Other Tax Relief Firm. All of the IRS records will be faxed to our office or well. However not filing taxes for 10 years or more exposes you to steep penalties and a potential prison term.

Tax not paid in full by the original due date of the return. Owe IRS 10K-110K Back Taxes Check Eligibility. Ad Find Out Why Precision Tax Gets The Highest Customer Ratings For IRS Tax Help.

If you owed taxes for the years you havent filed the IRS has not forgotten. See if you Qualify for IRS Fresh Start Request Online. Call the IRS or your tax pro can use a dedicated hotline to confirm the unfiled years.

Overview of Basic IRS filing requirements. IRS debt falls off 10 years after the return is filed. Ad Owe back tax 10K-200K.

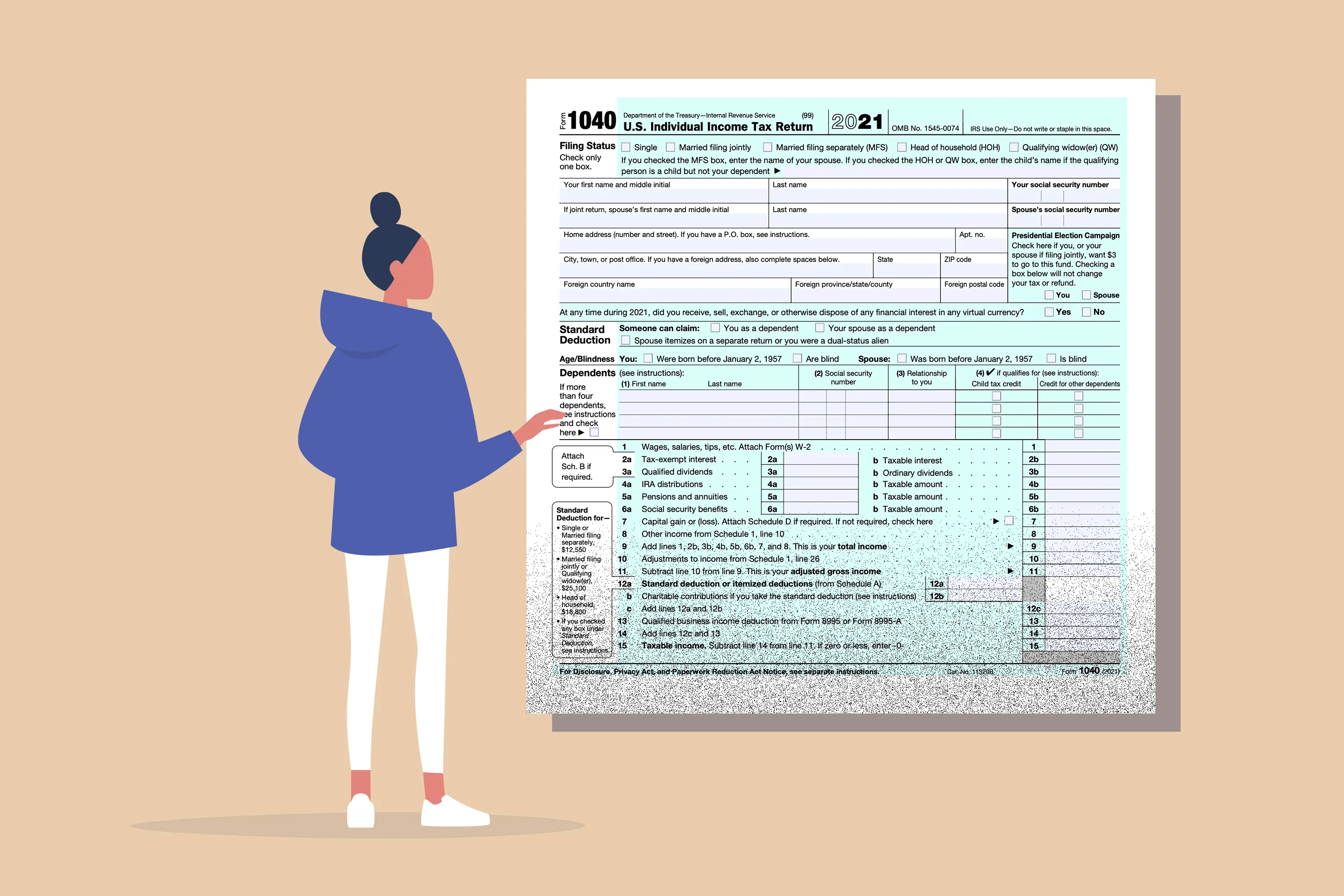

You can only get a refund 3 years after the return is supposed to be filed. You are only required to file a tax return if you meet specific requirements in a given tax year. The IRS doesnt pay old refunds.

Make a determination order records and file the returns. If you have unfiled returns for multiple years you should first get a copy of your IRS account transcripts which will show what returns havent been filed and what actions the. You may be subject to the failure-to-file penalty unless you have reasonable cause for your failure to file timely.

Capture Your W-2 In A Snap And File Your Tax Returns With Ease. What Should I Do If I Have Not Filed Tax Returns for Years. Ad Find Out Why Precision Tax Gets The Highest Customer Ratings For IRS Tax Help.

Created By Former Tax Firm Owners Based on Factors They Know are Important. Havent Filed Taxes in 10 Years. More 5-Star Reviews Than Any Other Tax Relief Firm.

My income is modest and I will likely receive a small refund for 2019 when I file. Ad Free tax support and direct deposit. If you have old unfiled tax.

For each return that is more than 60 days past its due date they will assess a 135 minimum. So 2011 refund can still be received if filed by April 15th 2015. Ad See the Top Rankings for Tax Help Companies That Fix IRS and State Tax Problems.

I havent filed taxes in over 10 years. You dont have to file taxes if There are very few circumstances that excuse your. What happens if you dont file taxes for 10 years or more.

In some cases people and businesses inform me that they have not filed for 10 to 20 years. You can only claim refunds for returns filed within three years of the. I dont own a home I have no investments.

Ad TurboTax Makes It Easy To Get Your Taxes Done Right. Luckily filing and paying your taxes is still possible even if you havent filed in a while. First if you do not have a.

Haven T Filed Income Tax Returns Yet Here S What Will Happen If You Miss Deadline Businesstoday

I Haven T Filed Taxes In 5 Years How Do I Start

Haven T Filed Taxes In Years What You Should Do Youtube

Find Out What To Do With A 1099 Form How To Include It With Your Personal Taxes And How To File This Type Of Income Tax Paying Taxes Income Income Tax Return

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Haven T Filed Taxes In Years What You Should Do Youtube

Haven T Filed Your Itr Yet Here S What Happens If You Miss The Deadline Today

Tax Season Is Here Integrity Tax Return Is Doing Free Quotes Over The Phone No Personal Info Needed We Are Offering Free Quotes Tax Return Tax Season

Top 10 Places To Do Your Taxes Online One Can T Help But Feel Frustrated Knowing That Tax Day Is Just Around T Customer Service Fails Tax Time Ace Cash Express

Irs Notice Cp59 Form 1040 Tax Return Not Filed H R Block

Haven T Filed Taxes In Years What You Should Do Youtube

Still Haven T Received Your Tax Refund Here S What The Holdup Could Be Cnet

Get Back On Track With The Irs When You Haven T Filed H R Block

How To File Taxes For Free In 2022 Money

Tax Preparation Software The Best Options For Easy Filing In 2022 Personal Finance Blogs Millennial Personal Finance Personal Finance Articles

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

Irs Notice Cp515 Tax Return Not Filed H R Block

These Tips From Personal Finance Expert Chris Hogan Can Save You A Lot Of Money When You File Taxes Filing Taxes Tax Season Personal Finance